How To Get Dcf Out Of Your Life

Discounted Cash Menstruum DCF Formula

How to calculate net present value

Guide to the Discounted Cash Flow DCF Formula

This commodity breaks down the discounted cash period DCF formula into simple terms. We will take you through the calculation pace by step so yous can easily calculate it on your own. The DCF formula is required in fiscal modeling to determine the value of a business when building a DCF model in Excel.

Watch this short video caption of how the DCF formula works.

Video: CFI's free Intro to Corporate Finance Course.

What is the Discounted Cash Period DCF Formula?

The discounted cash flow (DCF) formula is equal to the sum of the cash flow in each period divided by ane plus the disbelieve rate (WACC) raised to the power of the period number.

Hither is the DCF formula:

![]()

Where:

CF = Cash Catamenia in the Period

r = the interest rate or discount rate

n = the catamenia number

Analyzing the Components of the Formula

one. Cash Menstruum (CF)

Greenbacks Menstruum (CF) represents the net cash payments an investor receives in a given period for owning a given security (bonds, shares, etc.)

When edifice a financial model of a visitor, the CF is typically what's known every bit unlevered free greenbacks period. When valuing a bond, the CF would be involvement and or principal payments.

To acquire more about the various types of cash flow, please read CFI'south cash menses guide.

2. Discount Charge per unit (r)

For business valuation purposes, the disbelieve charge per unit is typically a firm'south Weighted Average Cost of Capital (WACC). Investors employ WACC because information technology represents the required rate of return that investors await from investing in the company.

For a bail, the discount rate would exist equal to the interest rate on the security.

3. Catamenia Number (n)

Each cash catamenia is associated with a time period. Common time periods are years, quarters, or months. The fourth dimension periods may be equal, or they may be different. If they're different, they're expressed equally a percentage of a year.

What is the DCF Formula Used For?

The DCF formula is used to determine the value of a business or a security. It represents the value an investor would be willing to pay for an investment, given a required rate of return on their investment (the discount rate).

Examples of Uses for the DCF Formula:

- To value an unabridged business

- To value a project or investment within a company

- To value a bail

- To value shares in a company

- To value an income-producing belongings

- To value the benefit of a price-saving initiative at a company

- To value anything that produces (or has an impact on) cash flow

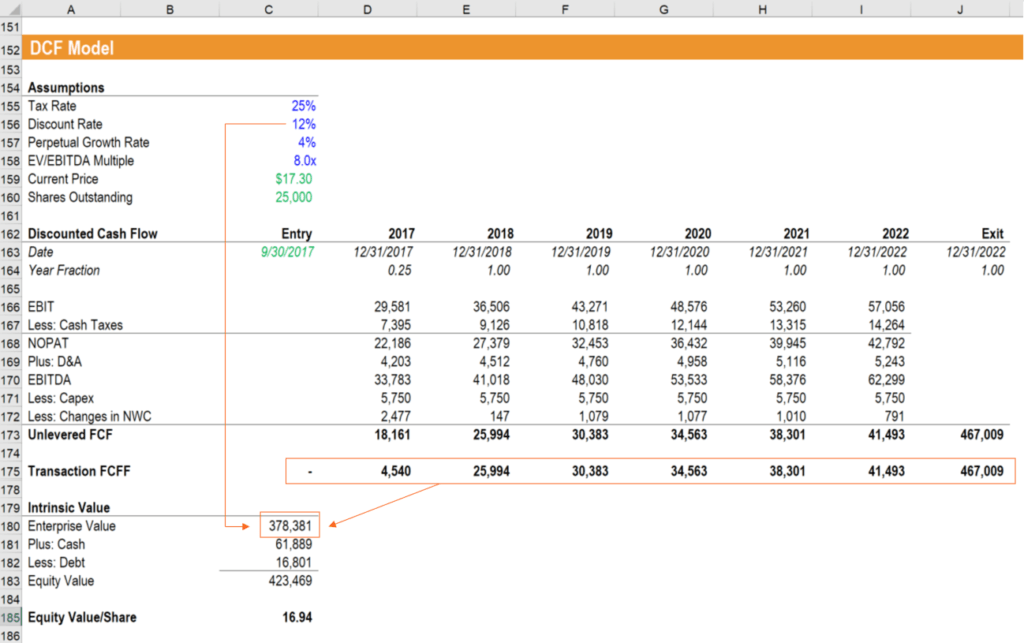

Below is a screenshot of the DCF formula existence used in a financial model to value a business. The Enterprise Value of the business is calculated using the =NPV() function forth with the discount rate of 12% and the Free Cash Flow to the Firm (FCFF) in each of the forecast periods, plus the last value.

Paradigm: CFI'south Concern Valuation Modeling Grade.

Download the Free Template

Enter your proper noun and email in the form below and download the free template at present!

DCF Model Template

Download the complimentary Excel template now to advance your finance knowledge!

What Does the Discounted Greenbacks Flow Formula Tell You?

When assessing a potential investment, it'southward important to take into account the time value of money or the required rate of return that you expect to receive.

The DCF formula takes into business relationship how much return you expect to earn, and the resulting value is how much you would be willing to pay for something to receive exactly that rate of return.

If you pay less than the DCF value, your rate of return will be higher than the discount rate.

If you pay more the DCF value, your rate of return will be lower than the discount.

Illustration of the DCF Formula

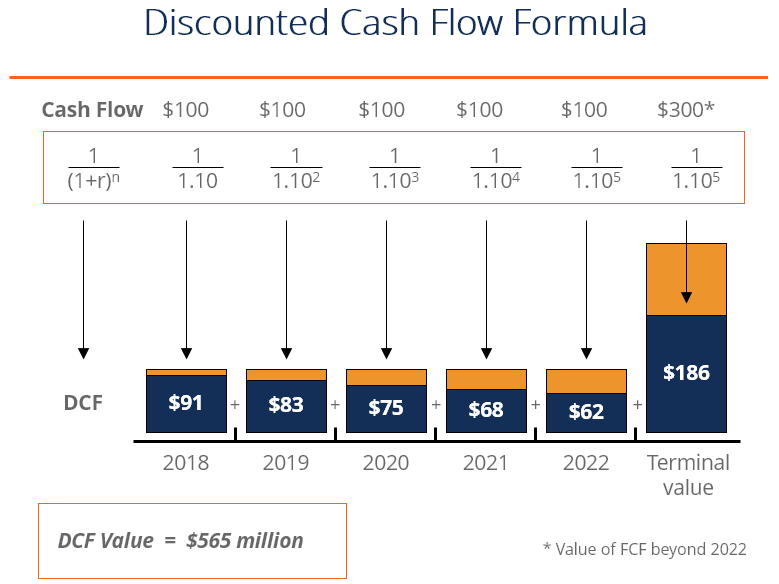

Beneath is an illustration of how the discounted cash menstruation DCF formula works. Equally you will encounter, the present value of equal cash menses payments is being reduced over time, as the effect of discounting impacts the greenbacks flows.

Image: CFI'southward free Intro to Corporate Finance Grade.

Terminal Value

When valuing a business organisation, the annual forecasted greenbacks flows typically used are 5 years into the time to come, at which signal a terminal value is used. The reason is that information technology becomes difficult to make reliable estimates of how a concern will perform that far out into the time to come.

There are 2 mutual methods of computing the terminal value:

- Exit multiple (where the concern is assumed to be sold)

- Perpetual growth (where the business is assumed to grow at a reasonable, fixed growth charge per unit forever)

Check out our guide on how to summate the DCF concluding value to learn more.

DCF vs. NPV

The total Discounted Cash Catamenia (DCF) of an investment is also referred to as the Net Nowadays Value (NPV). If we break the term NPV we tin can see why this is the case:

Net = the sum of all positive and negative cash flows

Present value = discounted dorsum to the time of the investment

DCF Formula in Excel

MS Excel has two formulas that can be used to summate discounted cash menses, which it terms as "NPV."

Regular NPV formula:

=NPV(discount charge per unit, series of cash flows)

This formula assumes that all cash flows received are spread over equal fourth dimension periods, whether years, quarters, months, or otherwise. The discount rate has to correspond to the cash catamenia periods, then an almanac discount rate of r% would apply to annual cash flows.

Fourth dimension adjusted NPV formula:

=XNPV(disbelieve rate, series of all cash flows, dates of all cash flows)

With XNPV, it's possible to discount cash flows that are received over irregular time periods. This is particularly useful in financial modeling when a company may be acquired partway through a year.

For example, this initial investment may be on August 15th, the side by side cash flow on December 31st, and every other cash flow thereafter a year autonomously. XNPV tin allow you lot to hands solve for this in Excel.

To learn more, see our guide on XNPV vs. NPV in Excel.

More than Helpful Resource

CFI's mission is to assistance you advance your career. With that mission in heed, we've compiled a broad range of helpful resources to guide you lot along your path to condign a certified Financial Modeling & Valuation Analyst (FMVA)® annotator.

Relevant resources include:

- Internal Rate of Return

- Valuation Methods

- DCF Modeling Tips

- Financial Modeling Best Practices

- Encounter all valuation resources

Source: https://corporatefinanceinstitute.com/resources/valuation/dcf-formula-guide/

0 Response to "How To Get Dcf Out Of Your Life"

Post a Comment